A comprehensive suite of financial planning tools

One platform for all your research and planning tools

Financial planning tools and investment research

Financial planning tools and investment research

Financial planning tools and investment research

Free for financial advisers

Free for financial advisers

Free for financial advisers

Find the right investments for your clients

Find the right investments for your clients

Analyse and build portfolios of MPS, funds, and stocks

Easily compare their performance, positioning, and latest portfolio changes

Analyse and build portfolios of MPS, funds, and stocks

Easily compare their performance, positioning, and latest portfolio changes

Access MPS data for 80+ DFMs, 3,000+ portfolios risk rated

Supported by DFMs, Mabel Insights is the largest freely accessible database in the UK for MPS and tailored MPS

Access MPS data for 80+ DFMs, 3,000+ portfolios risk rated

Supported by DFMs, Mabel Insights is the largest freely accessible database in the UK for MPS and tailored MPS

Risk is losing money

Mabel Risk Ratings focus on the probability of losing money. For each risk profile we capture the trade off between protecting capital in volatile markets and growth

Risk is losing money

Mabel Risk Ratings focus on the probability of losing money. For each risk profile we capture the trade off between protecting capital in volatile markets and growth

One platform for all your financial planning tools

One platform for all your financial planning tools

Back office connected

Custom branding

Create robust and engaging cashflow plans

Plan your client's finances - Mabel's cashflow and financial planning tools can help you improve client understanding and engagement and assess the probability of meeting their future expenses.

Tax optimised - Optimise a plans withdrawals strategy with a single click to minimise a client's tax payments

Deterministic and stochastic modelling - Run market simulations to stress test a plans ability to meet future expenses and assess a client's capacity for loss

Plan your client's finances - Mabel's cashflow and financial planning tools can help you improve client understanding and engagement and assess the probability of meeting their future expenses.

Tax optimised - Optimise a plans withdrawals strategy with a single click to minimise a client's tax payments

Deterministic and stochastic modelling - Run market simulations to stress test a plans ability to meet future expenses and assess a client's capacity for loss

Custom branding

3,000+ portfolios risk rated

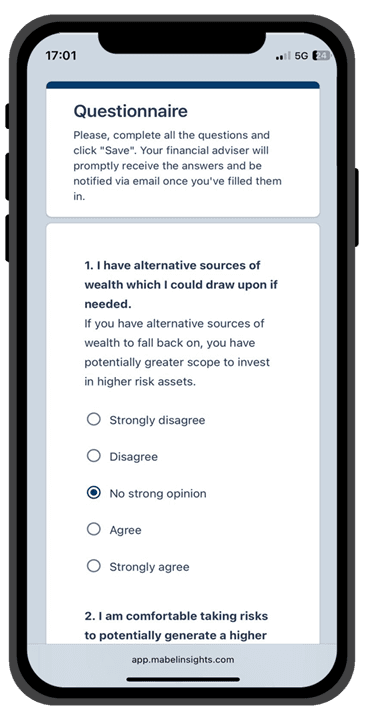

Risk Profiling

Risk Profiling

Digital - Effortlessly send questionnaires to your clients via email and get notified when completed

Accumulation and Decumulation options - Whether your client is retired or planning for retirement, our questionnaire asks the right questions

10 questions - Our easy to follow questions cover your client's risk need, risk taking ability and loss tolerance

Digital - Effortlessly send questionnaires to your clients via email and get notified when completed

Accumulation and Decumulation options - Whether your client is retired or planning for retirement, our questionnaire asks the right questions

10 questions - Our easy to follow questions cover your client's risk need, risk taking ability and loss tolerance

Back office connected

Custom branding

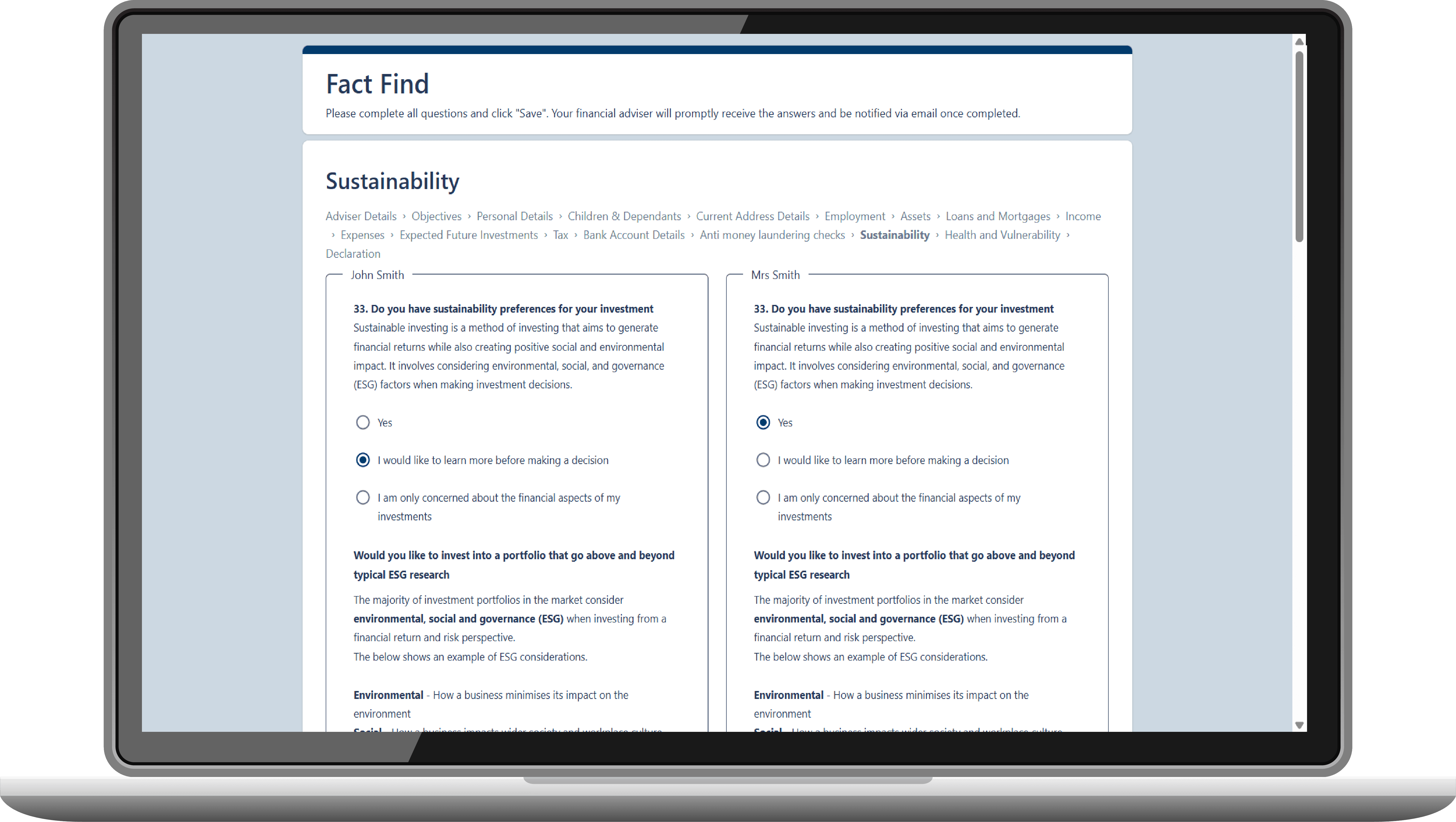

Customisable Fact Find

Customisable Fact Find

Tailor your fact find - Select and send specific sections of a fact find to your clients

Digital - Effortlessly send the fact find to your clients via email and get notified when completed

Back office connected - Push and pull data between Mabel Insights and your back office system

Tailor your fact find - Select and send specific sections of a fact find to your clients

Digital - Effortlessly send the fact find to your clients via email and get notified when completed

Back office connected - Push and pull data between Mabel Insights and your back office system

Our financial planning tools connect with your back office system

Our financial planning tools connect with your back office system

Seamless automation

Real-Time sync

Secure and scalable

Plug and play setup